Finance Lease Disclosure Example ~ Indeed recently has been hunted by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about Finance Lease Disclosure Example. The current liability is the amount of principal payable in the next twelve months plus any accrued interest and. The earlier of lease agreement and the date of commitment by the parties the type of lease is identified at the date of inception. So as an example the company has to disclose its. The non current liability is the amount of the principal payable in a period greater than twelve. Asc 842 20 55 53 provides an example of these disclosures disclose maturity. Financial reporting standards expert steve collings works through an example of a finance lease and how the interest is recognised under frs 102 using the effective interest method. Assets subject to operating leases continue to be presented according to the nature of the underlying asset. A lessee must split the finance lease liabilities between the current liability and non current liability. Ias 17 prescribes the accounting policies and disclosures applicable to leases both for lessees and lessors. Asc 842 provides an example of how the quantitative disclosure could be displayed in example 6 asc 842 20 55 4. Interest rate implicit in lease. For finance leases the net investment is presented on the balance sheet as a receivable and. Finance lease costs segregated between interest and amortization. Key metrics will be affected by the recognition of new assets and liabilities and differences in the timing and classification of lease income expense. Under frs 102 the financial reporting standard applicable in the uk and republic of ireland leasing transactions are dealt with in section 20 leases. Your essential guide to the new lease disclosures. Asc 842 leases is a comprehensive change from previous guidance that requires both finance and operating leases to be recognized on the balance sheet where only finance historically called capital leases were recorded previously. The new disclosure requirements will potentially require new process and controls especially related to the accounting for operating leases. So similarly the fasb required that all the quantitative disclosures that are required for leases must also be segregated between operating leases and finance leases. Ifrs 16 leases requires lessees to recognise new assets and liabilities under an on balance sheet accounting model that is similar to current finance lease accounting.

A lessee must split the finance lease liabilities between the current liability and non current liability. Under frs 102 the financial reporting standard applicable in the uk and republic of ireland leasing transactions are dealt with in section 20 leases. So similarly the fasb required that all the quantitative disclosures that are required for leases must also be segregated between operating leases and finance leases. If you are searching for Finance Lease Disclosure Example you've arrived at the ideal place. We have 12 images about finance lease disclosure example including images, photos, photographs, backgrounds, and much more. In these webpage, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Financial reporting standards expert steve collings works through an example of a finance lease and how the interest is recognised under frs 102 using the effective interest method.

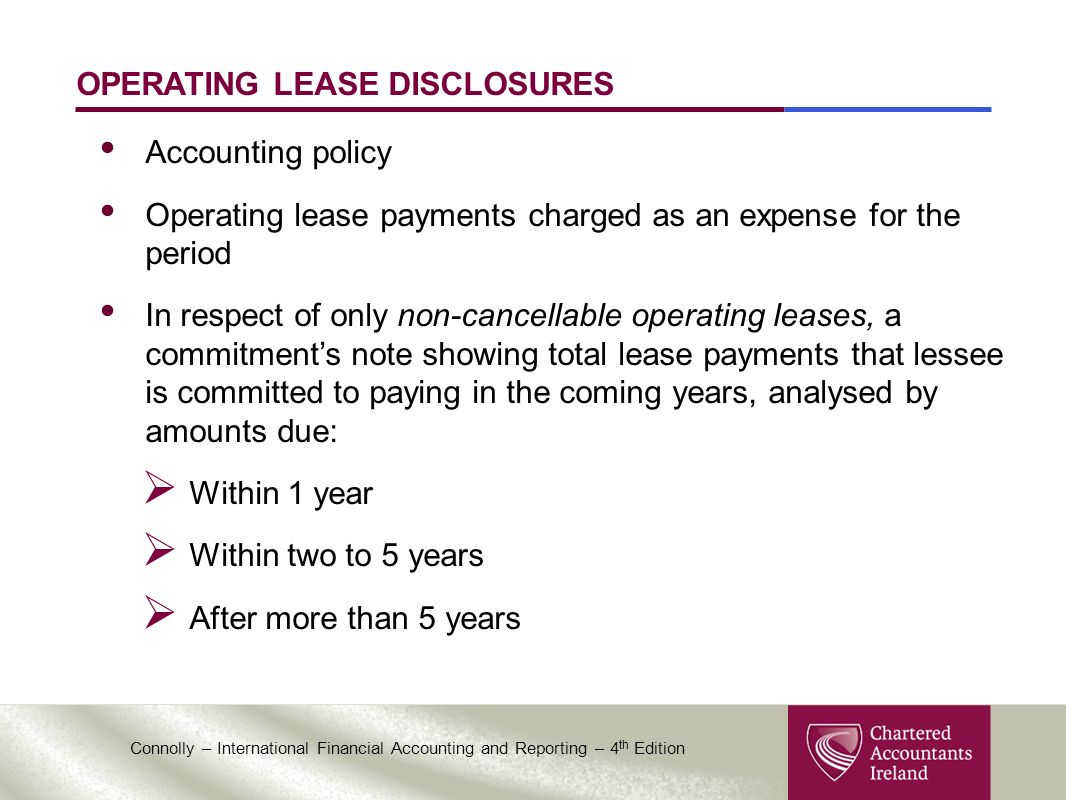

Interest rate implicit in lease. Financial reporting standards expert steve collings works through an example of a finance lease and how the interest is recognised under frs 102 using the effective interest method. The new disclosure requirements will potentially require new process and controls especially related to the accounting for operating leases. Assets subject to operating leases continue to be presented according to the nature of the underlying asset.